Earnings Flash Note: Credo Technology ($CRDO) Q2 FY2026 Results and Analysis

Status: Earnings & Call Wrap-Up; Headline: Supercycle Confirmed by "Perfect Quarter"; CEO Bill Brennan Unveils Three New Multi-Billion Dollar Opportunities

Dear visitor, by reading this article, you acknowledge that you have reviewed and agree to the disclaimer outlined on this Substack.

1. Executive Summary: The AI Inflection is Here

The second quarter of fiscal year 2026 results were just released by Credo Technology Group Holding Ltd (NASDAQ: CRDO 0.00%↑) on December 1st, 2025.

Three words: they smashed it! This represents more than a mere earnings beat; it serves as a definitive validation of the company’s strategic positioning at the nexus of the artificial intelligence (AI) infrastructure boom. Credo unequivocally validate their position in the AI infrastructure supercycle.

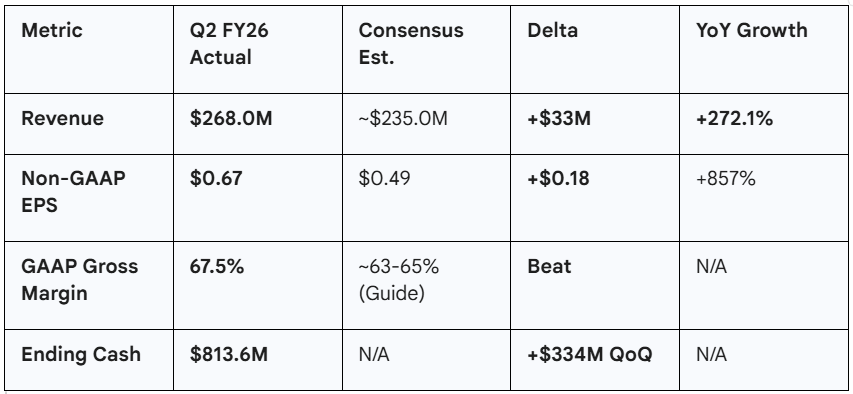

The company delivered a “perfect” quarter: a massive beat on top-line revenue ($268M vs. ~$235M cons), a significant beat on profitability (Non-GAAP EPS $0.67 vs $0.49 cons), and a guidance raise for Q3 that suggests the ramp is accelerating, not slowing.1

However, the real story of the earnings call was CEO Bill Brennan’s unveiling of three new product pillars, ZeroFlap Optics, Active LED Cables, ALCs, and OmniConnect, which he claims expands Credo’s total addressable market, TAM, to over $10 billion.1

For investors (like myself 😊) who identified the “connectivity bottleneck” thesis early on, perhaps securing a position near the single digit lows of May 2023, this quarter serves as the definitive validation of that long-term conviction.

2. Q2 FY2026 Financial Breakdown, The Explosion of Growth

The financial results for Q2 FY2026 demonstrated that the AI-driven ramp accelerated sharply, justifying the hyper, growth description.2 Quarterly revenue reached $268 million, which not only surpassed the consensus estimate but represented an extraordinary 272% increase YoY, and a 20% increase sequentially, QoQ, from the prior quarter.2

This “explosion” of growth is particularly noteworthy when looking at the historical trajectory. While Credo’s annual revenue growth was a robust 72.99% in fiscal year 2023, it slowed briefly in fiscal year 2024 to 4.76%, before spiking by 126.34% in fiscal year 2025.5 The current 272% YoY growth confirms the massive scale, up tied to the AI cluster buildout has truly hit an inflection point.2

Guidance Update: Q3 Revenue is guided to $335M - $345M, implying ~27% sequential growth, suggesting the acceleration is far from over.2

Customer Diversification: Four hyperscalers are now 10%, plus customers. A fifth is ramping now.1

3. CEO Bill Brennan’s Strategic Update: The “Five Pillars”

Based on the Q2 FY2026 Earnings Call Transcript

CEO Bill Brennan used the call to transition the narrative from “AEC Company” to “Comprehensive Connectivity Provider.” He detailed five key technologies, moving the company from focusing on a single product franchise to owning the entire connectivity layer, which is crucial for managing the scale, density, and complexity of modern AI clusters.1

3.1. AECs (Active Electrical Cables): The “De Facto Standard”

Mr. Brennan confirmed that AECs remain the fastest-growing segment.

Market Position: AECs are now the “de facto standard” for in-rack connectivity, displacing optical connections for distances up to 7 meters.

The Driver: As clusters move to 100k+ GPUs, reliability is paramount. Mr. Brennan noted that “ZeroFlap AEC deliver up to 1000 times better reliability than traditional laser based optical modules.”3 This stability is mission, critical when training jobs cost tens of millions of dollars.1

3.2. ZF Optics, ZeroFlap Optics, and ALCs, Active LED Cables,

The new pillars introduce optical solutions where reliability is engineered into the product, starting with ZF Optics.

ZF Optics are designed to solve the problem of “link flaps,” momentary disconnects that can stall costly AI training jobs.1 These new laser, based optical modules use a custom optical Digital Signal Processor, DSP, tightly coupled with switch, level software to autonomously detect and mitigate degrading links before they fail, which is a step, function improvement in network reliability.3 This capability addresses any length of connection beyond 7 meters.1

The second key pillar, Active LED Cables, ALCs, stems from the acquisition of the Hyperlume team and their expertise in high, performance MicroLED technology.1 ALCs use MicroLEDs instead of lasers as the light source, creating a thin, gauge cable that matches the power and reliability of copper AECs, but extends the reach to 30 meters, targeting “row, scale” networks.1 Brennan strongly believes the ALC TAM will ultimately be more than double the size of the AEC TAM.1

3.3. OmniConnect Gearboxes, The “Weaver”

The final pillar is the OmniConnect gearboxes, notably the “Weaver” solution, which addresses the memory wall.1

This gearbox chip allows system designers to move from expensive, capacity, constrained High Bandwidth Memory, HBM, to commodity DDR memory, while achieving up to 30 times more memory capacity and eight times the bandwidth, a game, changer for memory, intensive AI workloads.1

4. The $5 Billion Question, Ambition, TAM, and Execution

CEO Bill Brennan’s stated long, term aspiration to achieve $5 billion in annual revenue is a profoundly ambitious target that requires flawless execution and a near, total market capture.1 This goal is fundamentally underpinned by the AEC Total Addressable Market, TAM, alone, which is already estimated to be between $5 billion and $10 billion.

To grow from Credo’s current sub, $1 billion revenue run rate to $5 billion, the company must successfully transition from being a fast, growing semiconductor specialist to a dominant global supplier across multiple product categories, including AECs, advanced optical DSPs, and new solutions like ZF Optics and ALCs.

This magnitude of growth implies that management views Credo’s technology as an essential industry standard, displacing legacy solutions in most major hyperscale deployments.1

To execute this, the company plans significant investments, forecasting a 50% YoY increase in operational expenses for fiscal year 2026, which is necessary to fund R&D, efforts and scale operational capacity to support this multi, billion, dollar vision.1 For investors, monitoring the company’s ability to maintain high gross margins while navigating this massive scale, up is the primary measure of success.

5. Supply Chain Hurdles and The Optical Frontier, Navigating BizLink and CPO Pitfalls

5.1. The Pitfalls of Co-packaged Optics, CPO

While the industry often discusses CPO, as the ultimate destination for bandwidth density, Mr. Brennan directly addressed the industry hype with skepticism, citing significant practical and financial pitfalls that validate Credo’s current focus on high, performance pluggable solutions.1

The CEO noted that CPO faces “reliability, serviceability, and maintenance costs” as major unresolved issues, concluding that he does not see hyperscalers moving to CPO anytime soon.1

From a technical and financial perspective, the challenges include:

Thermal Management, Integrating heat, sensitive optical components and high, power ASICs, within a single package creates extreme heat, making expensive liquid cooling systems a near, mandatory requirement for data centers adopting CPO.

Manufacturing Complexity, CPO fabrication requires complex, advanced processes, such as Through, Silicon Via, TSV, structures and the integration of III, V compound materials, which introduce significant risk to manufacturing yield and long, term reliability.

Cost, At present, CPO does not offer a significant cost advantage over existing high, volume pluggable optics, making the massive infrastructural switch financially hard to justify for many customers.

Credo’s strategy of pushing the performance and reliability of pluggable solutions, like ZF Optics and ALCs, effectively gives hyperscalers a superior alternative, allowing them to defer the high costs and operational risks associated with CPO deployment until the technology matures.

5.2. Managing Supplier Concentration and Wafer Capacity

The company’s ability to execute on its massive growth forecasts is intrinsically linked to managing its supply chain. Credo relies primarily on BizLink as its sole provider of Active Electrical Cable manufacturing. While the CEO expressed confidence in their ability to manage this vertically integrated supply chain, he acknowledged a broader industry issue, a potential constraint in advanced wafer foundry capacity.1

Mr. Brennan noted that the market in general might soon become “self regulated by foundry capacity,” particularly at the leading edge nodes like 3 nm or 5 nm.1 However, he emphasized that Credo’s use of the more available 12 nm process node for their workhorse products gives them an advantage in securing supply.1 Furthermore, because Credo’s connectivity solutions are “critical for shipping GPUs,” their foundry partners are incentivized to prioritize their relatively small die requirements.1 This operational advantage, based on strategic process node selection, is key to mitigating potential supply chain bottlenecks.

6. Conclusion (and a personal note)

Credo Technology’s Q2 FY2026 results represent a watershed moment, confirming that my early investment thesis, created when the stock was trading in the single digits, has fully materialized. The record revenue and profitability confirm Credo’s status as an essential AI infrastructure pure play, uniquely positioned to solve the high, speed connectivity bottleneck.

The layered strategy, which focuses on dominating the cost, effective AEC market while simultaneously pioneering differentiated, high, reliability optical solutions like ZF Optics and ALCs, is highly effective for maximizing revenue in the near term while securing future market leadership.1

The $5 billion revenue target, while audacious, is structurally supported by the massive, multi, billion, dollar TAM for connectivity. Investors should focus on the continued stability of Credo’s high gross margins and the successful execution of their ambitious product roadmap, ensuring the technological superiority translates into sustained, multi-year market dominance.

A. Sources Cited

Credo Technology Group Holding Ltd, “Reports Second Quarter of Fiscal Year 2026 Financial Results,” (December 1, 2025). URL.

Q2 FY2026 Earnings Call Transcript (December 1, 2025). 1

B. Works Cited

Q2 FY2026 Earnings Call Transcript (December 1, 2025). 1

Credo Technology beat Wall Street estimates amid AI infra boom, accessed December 2, 2025, https://www.investing.com/news/earnings/credo-technology-beat-wall-street-estimates-amid-ai-infra-boom-4384564

香港商默升科技有限公司台灣分公司 |徵才中 - 104人力銀行, accessed December 2, 2025, https://www.104.com.tw/company/1a2x6bkfzs

Credo Technology Holding earnings beat by $0.18, revenue topped estimates, accessed December 2, 2025, https://www.investing.com/news/earnings/credo-technology-holding-earnings-beat-by-018-revenue-topped-estimates-4384691

Credo Technology Revenue 2021-2025 | CRDO - Macrotrends, accessed December 2, 2025, https://www.macrotrends.net/stocks/charts/CRDO/credo-technology/revenue

C. Full Q2 FY2026 Earnings Call Transcript

Operator: Ladies and gentlemen, thank you for standing by. At this time, all participants are in a listen only mode. Later we will conduct a question and answer session. At that time, if you have a question, please press star. Then the number one on your telephone keypad. If you would like to withdraw your question at any time, simply press star one. Again, I’d now like to turn the conference over to Dan O’Neil. Please go ahead, sir. Good afternoon. Thank you for joining our earnings call for the second quarter of fiscal 2026. Today, I am joined by Bill Brennan, Chief Executive Officer, and Dan Fleming, Chief Financial Officer. This call, we will make certain forward looking statements. The forward looking statements are subject to risks and uncertainties discussed in detail in our documents filed with the SEC, which can be found in the Investor Relations section of the company’s website. It’s not possible for the company’s management to predict all risks, nor can the company assess the impact of all factors on its business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward looking statement. Given these risks and and assumptions, the forward looking events discussed during this call may not occur. In actual results could differ materially and adversely from those anticipated or implied. The company undertakes no obligation to publicly update forward looking statements for any reason after the date of this call to conform...source GAAP. Discussion of why we use non-GAAP financial measures and reconciliations between our GAAP and non-GAAP financial measures is available in the earnings release we issued today, which can be accessed using the Investor Relations portion of our website. I will now turn the call over to our CEO, Bill. Thanks,

Bill Brennan: Dan, and thank you, everyone for joining our fiscal 26 second quarter earnings call. I’ll walk through our Q2 results, highlight the transformative developments we’ve announced since our last call. And then share our forward outlook. After my remarks, our chief Financial Officer, Dan Fleming, will provide a detailed financial review and our guidance for the third quarter. In the second quarter, we delivered record revenue of $268 million, representing 20% sequential growth from Q1 and an extraordinary 272% increase year over year. non-GAAP gross margin came in at a robust 67.7%, and we generated approximately $128 million of non-GAAP net income. These are the strongest quarterly results in history, and they reflect the continued build out of the world’s largest AI training and inference clusters. AI clusters are no longer measured in tens of thousands of GPUs. They’re now measured in hundreds of thousands and soon millions. The scale, density, and complexity of these systems are pushing every aspect of interconnect reliability, power efficiency, signal integrity. Latency reach, and total cost of ownership have all become mission critical. This is the challenge our customers face, and it’s where Credo is uniquely positioned to deliver this solutions. They need to succeed. Our three tiered innovation framework, purpose built service technology, world class IC design, and a true system level development approach. All wrapped with our industry leading pilot debug and telemetry platform. Has allowed us to forge deep strategic partnerships. Let me now walk through our business in detail. Starting with our active electrical cables. The AEC product line remains the fastest growing segment in the company. AEC revenue again grew strongly, driven by rapidly increasing customer diversity. In Q2, for hyperscalers, each contributed more than 10% of total revenue. The fourth Hyperscaler is now in full volume ramp, and a fifth started contributing initial revenue. Customer forecasts have strengthened across the board in the past months. Aecs have become the de facto standard for interact connectivity, and are now displacing optical rack to rack connections up to seven meters. At 100 gig per lane today and 200 gig per lane tomorrow. Zero flap AEC deliver up to 1000 times better reliability than traditional laser based optical modules. While consuming roughly half the power when you’re installing a 100,000 GPU cluster, link flaps can delay time to stability and time to revenue, and when you’re training a model costing tens of millions of dollars. Link flaps can have a significant impact on overall uptime and productivity. It is this step function improvement in reliability and power efficiency. That’s driving the expansion of the AEC Tam in the 100 gig and now 200 gig per lane generations, and we expect that trend to continue as customers densify racks and push cluster scale to new levels. Next, our IC business, which includes re timers and optical DSPs also. Continued with strong performance. We expect significant optical DSP growth in fiscal 26. Driven by 50 gig and 100 gig per lane deployments with longer term growth driven by our 200 gig per lane solutions. Live demonstrations last quarter of our 200 gig per lane Bluebird Optical DSP drew significant interest and extremely positive feedback. Ethernet. Retailers remain important in both traditional switching fabrics and the fast growing AI server segment, where features like Macsec encryption, gearbox functionality, and rich software programmability are highly valued. Our PCIe reclaimer and AEC families are also progressing on plan customers. Silicon evaluations have consistently highlighted our best in class combination of reach. Latency and power efficiency. A rare trifecta enabled by our unique purpose built Surtees architecture. We remain on track for PCIe design wins in fiscal 26, followed by meaningful production revenue in fiscal 27. Our existing AEC and IC businesses, both address multibillion dollar market opportunities, with excellent visibility for continued growth. But the truly exciting part of this quarter is that we’ve added three entirely new growth pillars, each representing distinct multibillion dollar market opportunities. That significantly expand our total addressable market and extend the reach and depth of our connectivity leadership. The first new growth pillar is zero flat optics. The first laser based optical connectivity family that delivers AEC class network reliability, enabled by a customized optical DSP that is tightly coupled with our pilot software and integrated with a switch level SDK. Our zero flap optics integrate with our customers network software. Link health telemetry data on each optical link enables autonomous detection and mitigation of conditions that cause link flaps before they bring down the cluster. This enables a step function improvement in network reliability. We’re currently in live data center trials with our lead partner, and we expect to begin sampling a second. US hyperscaler later this fiscal year. Our ZF optical expand, our addressable market to any length of connection within the data center. We anticipate initial revenue in fiscal 27 and long term, a market that will be a multibillion dollar opportunity. The second new pillar of growth was announced in September. Credo has combined forces with Ottawa based Hyperloop, a team of experts specializing in high performance, micro led technology. Credo has been investing in Micro-led innovation over the past 18 months, with the intent of developing a new class of connectivity solutions, uniting with the Hyperloop team will accelerate our time to market. As the first product, we’ll develop and bring to market a pluggable optical solution that utilizes Microleds as the light source, our same three tiered innovation playbook will be the catalyst to pioneering this entirely new connectivity category. We call active LED cables, or Alks. Alks will deliver the same reliability and power profile as an AEC, but in a thin gauge cable that can reach up to 30m and is ideal for row scale scale up networks. Customer reaction has been very positive. We plan to sample the first ALK products to lead customers during our fiscal 27, with initial revenue ramping in fiscal 28, we believe the ALK ten will ultimately be more than double the size of the AEC ten. Finally, we announced the third new pillar of long term revenue growth Oneconnect gearboxes, a family of products that will enable a disaggregated and optimized approach to xpu connectivity. In November, together with our lead customer, we unveiled the first gearbox that will address the memory wall by redefining memory to compute connectivity. A solution we call Weaver. Today’s on package high bandwidth memory is capacity and throughput limited, as well as expensive and supply chain constrained. We’ve allows designers to move to commodity DDR memory and achieve up to 30 times more memory capacity, and eight times the bandwidth. The key enabler for the Oneconnect family is Credo’s purpose built, 112 gig DSR service that enables a ten x improvement in beachfront I o density and has a reach of up to ten inches. The Weaver gearbox from 112 gig BSR to DDR. Effectively overcomes the physical and logical limitation of current memory to compute connectivity solutions. Our first customer for Weaver announced their plan to deliver an Xpu targeted for inference with two terabytes of memory capacity, a complete game changer for workloads such as real time AI, video generation, and full self-driving. Where memory capacity and bandwidth are the primary gating factors. Industry. Forecasters project the memory to compute Connectivity market to be a multibillion dollar market by the end of the decade. We anticipate initial revenue in our fiscal 28 with significant scaling thereafter. The next Omni Connect gearbox is to be introduced will provide a future enabled path to scale out, scale up and near package optics connectivity with experts. In summary, we now have five distinct high growth connectivity pillars. IC solutions, including timers and optical DSPs, zero flap optics. Alks and Omni Connect gearbox solutions. Together, they’ll give credo a combined total market opportunity that we believe will exceed $10 billion in the coming years, more than triple where we stood just 18 months ago. Looking forward, we couldn’t be more excited about the combination of continued growth in our core AEC and IC businesses. Plus the upcoming ramps of zero flap optics, DLCs and Omni Connect gearboxes. We believe this combination gives us a strong outlook into continued revenue growth through fiscal 26 and well beyond. Team credo continues to execute at an elite level, delivering record results quarter after quarter, while simultaneously pioneering and launching new multibillion dollar product categories. I’m proud of our world class operational excellence and innovation. With that, I’ll turn the call over to Dan Fleming for a detailed financial review and our Q3 guidance. Thank you, Bill, and good afternoon. I will first review our Q2 results and then discuss our outlook for Q3 of fiscal year 26. In

Dan Fleming: Q2, we reported revenue of $268 million, up 20% sequentially. And up 272% year over year. And well above the high end of our guidance range. Our product business generated $261.3 million of revenue in Q2, up 20% sequentially and up 278% year over year. Notably, our AEC product line again grew healthy double digits sequentially to achieve new record revenue levels once again based on substantial year over year growth across four domestic hyperscale customers. Our top four end customers were each greater than 10% of revenue in Q2. As a reminder, customer mix will vary from quarter to quarter, and we continue to make progress in diversifying our customer base. We continue to expect that 3 to 4 customers will be greater than 10% of revenue in the coming quarters, and fiscal year, as hyperscale customers continue to ramp to more significant volumes. And as we expect to begin to ramp an additional hyperscale customer in the coming quarters. Our team delivered Q2 non-GAAP gross margin of 67.7%, above the high end of our guidance range, and up 11 basis points sequentially. Our product, non-GAAP gross margin was 66.8% in the quarter, up 18 basis points sequentially and up 469 basis points year over year. Total non-GAAP operating expenses in the second quarter were $57.3 million, slightly above the midpoint of our guidance range, and up 5% sequentially. Our non-GAAP operating income was $124.1 million in Q2, compared to non-GAAP operating income of $96.2 million in Q1, up demonstrably due to the leverage attained by achieving more than 20% sequential top line growth. While opex growth was in the mid-single digits. Our non-GAAP operating margin was 46.3% in the quarter, compared to a non-GAAP operating margin of 43.1% in the prior quarter, a sequential increase of 319 basis points. Our bottom line once again demonstrated the substantial leverage we are delivering in the business. Our non-GAAP net income was $127.8 million in the quarter, a record high and a 30% sequential increase compared to non-GAAP net income of $98.3 million in Q1. And our non-GAAP net margin was 47.7% in the quarter. As we drove significant leverage in the business. Cash flow from operations in the second quarter was $61.7 million, up $7.5 million sequentially. CapEx was $23.2 million in the quarter, driven largely by purchases of production mask sets and free cash flow was $38.5 million, down from $51.3 million from the first quarter, due to higher CapEx investments. We ended the quarter with cash and equivalents of $813.6 million, an increase of $333.9 million from the first quarter, up largely from the proceeds of our ATM offering, which began in October. We remain well capitalized to continue investing in our growth opportunities while maintaining a substantial cash buffer. Our Q2 ending inventory was $150.2 million, up $33.5 million sequentially. Now, turning to our guidance. We currently expect revenue in Q3 of fiscal 26 to be between 300 and $35 million and $345 million, up 27% sequentially at the midpoint. We expect Q3 non-GAAP gross margin to be within a range of 64 to 66%. We expect Q3, non-GAAP operating expenses to be between $68 million and $72 million. We expect Q3 diluted weighted average share count to be approximately 194 million shares. These expectations are based on the current tariff regime, which remains fluid. As we look toward the end of fiscal year 26 and into fiscal 27, we expect sequential revenue growth in the mid-single digits, leading to more than 170% year over year growth in the current fiscal year. We expect each of our top four customers from Q2 to grow significantly year over year. In fiscal year 26, we also expect revenue diversification to strengthen further with our fourth customer, surpassing the 10% revenue threshold for this fiscal year. We expect non-GAAP operating expenses to increase year over year by approximately 50% in fiscal year 26, as a result, we expect our non-GAAP net margin to be approximately 45% for fiscal year 26. This should translate to net income more than quadrupling year over year. And with that, I will open it up for questions. Thank you. I’d like to remind everyone, in order to ask a question, please press star. Then the number one on your telephone keypad. We’ll pause just for a moment to compile the Q&A roster. And your first question comes from the line of Tom O’Malley with Barclays. Your line is open. Hey, guys. Thanks for taking my question.

Tom O’Malley: I appreciate it. So you’re seeing an expansion of the AEC market pretty rapidly here with the fourth. And then now soon to be the fifth 10% customer kind of rolling on. I found it interesting amidst what is clearly like a really strong ramp in the AEC market, you’re able to say that when you look at the the ALK market, you could see that being double the AEC, Tam. So talking big numbers, maybe you could spend a little time talking about whether that’s unit driven, whether that’s ASP driven. Just surprise given the size of given how well AEC have done. Thank you. Yes.

Bill Brennan: I think it’s a combination of of both the quantity as as well as ASPs. Now, when we think about when we think about Alks, it’s really an ideal product from the standpoint of, you know, delivering the same reliability as AEC, which is really, you know, the most critical factor right now with with host to C0 or, or GPU to switch connections. Also, you know, from a power efficiency standpoint, it’s in the it’s in the same class as AEC. I would. Say from a, you know, from a system cost perspective. Again, you know, in that same class, what what it delivers is a thinner wire gauge and longer length. And as we’ve as we see the scale up networks really going from interact to row scale, we’re talking about a tremendous increase in the number of connections. We estimate that it could be up to ten times that of the number of scale out connections. And so, yes, we are really, really bullish and, and and we’re strong believers in Micro-led as a technology that’s really going to be a game changer for us as well as our customers. And then just on the timing and the scale of the other customers ramping on, maybe you could give us what the percentages of the top four were this quarter. And then any commentary on how large those other customers rolling on will be, just to give us a feel for how one is kind of handing off to the next over the next couple of quarters would be super helpful. Thank you again. Sure,

Dan Fleming: Tom. So for for Q2, as we mentioned in my prepared remarks, we had 410 customers. The largest was 42% of revenue. And that was the customer that we’ve in the past said we expect to be the largest customer this fiscal year, the second largest was 24%, which happened to be our first hyperscaler to ramp a few years back. Third largest was 16%, which was our largest customer in Q1. And the fourth was 11%, which is our newest hyperscaler that we’ve discussed in the past. So when you kind of plot that all out, what you see and what we’ve been fairly consistent in saying is that the ramp at any given single hyperscaler is never really linear. So we’re seeing that with our largest customer from last quarter taking a bit of a pause. This quarter. But our largest customer for this fiscal year, which had been down for the last few quarters, is back up again. So there is a there is definitely a give and take that we’re managing through. And again, we have 12 months visibility in some cases, even greater visibility with our customers in order to be able to manage that through the course of time. It’s hard to predict exactly how things are going to fall quarter to quarter. Longer term. But but hopefully that gives you a kind of a flavor as to what we’re seeing kind of on the ground right now, today. And your next question comes from the line of Thor Svanberg with Stifel. Your line is open. Yes.

Thor Svanberg: Congratulations on the solid results, Bill. I had a question on your sort of three new product lines here. Obviously all in the optical domain. You know, first of all, could you maybe elaborate a little bit on on how much you’re focusing on the system level products? You know, because obviously in copper, yeah, you have system level products. But the three areas in optical, you know, how much of those should we assume are systems. And then have a follow up. Thank you. Yeah. So we’ve we’ve been very consistent in in talking about our intent to continue to expand our portfolio portfolio at the system level. And I would say that that yes. Alex, as well as optics, those are both optical solutions that the Oneconnect family will be initially copper based. And then longer term will offer Nir package optics options. With that. And so I think that. You know, from the standpoint of delivering value to our customers. We are very much focused on on delivering non-commodity non IEEE standard. You know well well beyond what that standard. You know, calls for. And I think ZF optics is a great example of that in a sense that you know going back 18 to 20 months ago. We really you know heard strong feedback from multiple customers that reliability was was the. The the top priority. As you know, people became more familiar with the issues that they were seeing with building out AI clusters. And so with one of the customers that we were on stage with at OCP, we got to work thinking about how do we integrate higher level within the stack, how do we integrate within the, you know, the network software for that customer within their AI cluster? And so the concept is, you know, how do we, you know, how do we provide more visibility, more telemetry, how do we make that information available and actionable at a network level? When we think about, you know, the, you know, the opportunity that we’re creating for our customer here is it’s really creating almost like a check engine light. Being able to set a threshold on on links, all of the links within a cluster and being able to sense real time when those any of those links are degrading, being able to set a threshold and once you know that signal integrity drops below that threshold, being able to action it by in an orderly fashion, taking that GPU out of the cluster. Before you see a link flap that could potentially take down take take down the cluster entirely. And so you know, that type of value add is, is, you know, completely innovative. And it’s, you know, defining a new class of optical connectivity. And it’s very, very targeted for for reliability. And that reliability is really with, you know, traditional laser based optical transceivers. You know, so that’s that’s been a big investment.

Bill Brennan: It had we delivered a custom optical DSP. We. You know, have the whole pilot telemetry platform is something that we’ve been working on for many years. And and there’s a lot of, you know, special development work that was done to tightly, tightly couple that optical DSP. And then integrating within, you know, a switch level SDK. This is these are all things that a system level that needed to be done to be able to bring this product to market. And when we think about Alex, I’ve talked about that. You know, that’s a game changer. It’s basically changing the light source to at a ground level, deliver better reliability. And when we think about our first gearbox in the Omni Connect family, it is a copper solution. But it’s redefining how memory. To compute or memory to xpu connectivity is done. And when we think about, you know, the alternative being HBM all in package, all, you know, driving extremely, you know, challenging heat dissipation environments. That translates directly to reliability as well. So being able to move the memory up to ten inches away, not only does it lift the the logical and physical limitation that you’ve got by being, you know, in a package with a beachfront I o density, that’s not as dense, it really eliminates the the reliability issue that you’ve got with the heat that’s generated by putting so much memory in it in a single package with the zpu. So it’s really a combination of both optical and copper, but again, we’re agnostic to the medium. We’re agnostic to to exactly how these. Are put together. Whether copper or fiber. It’s ultimately delivering a solution to to the customers. That is just much better than it’s in the market today. That’s that’s very helpful. Thank you for that. And that’s my follow up. And I’m very interested in the 112 gig DSR service technology. I think you mentioned initially it’s going to be copper, but eventually you’re going to have an optical solution as well. I’m just curious, the, you know, would you have to develop, you know, some silicon photonics technology there, or would that still sort of be a solution in the pure silicon domain? Thank you. Yeah. So regarding the, the, the service that was developed, you know, specifically for this application, you know, I love the arguments in the market about, you know, who’s got the best service. And a lot of times in the market, you know, people like to think the longest reach service is obviously the best. We look at it differently. We really look at it from an application specific perspective. And so when we think about the idea of, you know, giving an xpu customer a piece of IP to integrate, we think about how do we achieve the the smallest footprint, the lowest power. And ultimately with this, with this vsr service that we developed on a max radical die, we can fit 1200 of these Surtees, creating 120 Terabits per second of potential bandwidth. That’s unprecedented. That you know that that has yet to be achieved, especially when you think about the reach being ten inches other competitive solutions. The reach would be, you know, an inch or less. And so, you know, basically you. Forcing there to be a die to die connectivity versus moving a chip outside the package. And so it’s a real breakthrough. I would argue that this Surtees is best in class, and it’s enabling, you know, entire family of solutions that range from, you know, I o solutions from memory, but also from from a scale out or scale up perspective and long term with, with Nir package optics and the Nir package optics will leverage the work that we’re doing in Micro-led. So first step will be Alks. And then we’ll roll that right into some, you know, some additional game changing applications. Like Nir package optics. Your next question comes from the line of Vivek Arya with Bank of America. Your line is open. Thanks for taking my question, Bill. Which applications are your for customers using X for today and which applications are they not yet using X for? And as we look into next year, there’s a lot of talk of co-packaged optics coming into the mix. And I was hoping you could give us a sense for what impact that might have on the current or future AEC usage by your customers. So the different applications that we’ve talked about in the past have been, number one, front end network connections, which of course, that was the the first application to ramp with our first customer years ago. We’ve also talked about the. The scale out opportunity. As part of the back end network of of AI clusters. The third application we’ve talked about is switch racks. And and that would be, you know, as opposed to buying a chassis filled with switches, you would stack those vertically in a rack and and that backplane connection with within a chassis would become a short cabled connection within the rack. Those are the first three applications we’ve talked about. And we are in production with all three of those with different customers. We’re definitely not fully penetrated with all of our customers, but we are in production with all three of those applications. I would say the, you know, the one remaining application that will be high volume is with the scale up network as that network goes rack scale and then ultimately goes ro scale, depending on the density and the number of number of racks that are being deployed. Now, as it relates to co-packaged optics, this is, you know, this is a. You know, this has been a long conversation really for the 12 years I’ve been involved in this industry. You know, there’s been a conversation about, you know, moving to a co-packaged. It’s changed names or changed acronyms over time. But I think that, you know, before it takes off in a really big way. There’s, got to be answers to the pitfalls that are very, very well known. Number one, related to reliability, serviceability, maintenance costs, of course, and we think that there’s solutions that are going to be more. Optimized from a power standpoint. More optimized from a reliability standpoint. And we’re focused on bringing those solutions to market really, maybe even within the same timeframe as people talk about co-packaged optics. So there’s been lots of demonstrations, but we don’t see a lot of customers moving forward in a big way that would have an impact on us. I think it’s safe to say that, you know, from that host to t0 connection, perspective, reliability is top. You know? Absolutely. You know, you know, top of the list on priorities. So I think we’re we’re, you know, that’s obviously a high volume part of the market. And we don’t see that, you know we don’t see that. Moving to co-packaged optics anytime soon. And for my follow up I’m curious how does your ASP lift from the 100 to 200 gig per lane compared to the lift that you have seen and are still seeing in the 50 to 100 gig transition? And you know, does the competitive landscape change as you start moving to 200 gig? You know, does that new application create a bigger opportunity for some of your competitors? Thank you. The question is a bit more complex than just thinking about moving from one lane speed to a faster lane speed. Our ASPs are are highly dependent on the number of connectors in the SKU. The. You know, the devices that we’re that we’re using within those connectors and the length of the connections. And so it’s, you know, it is safe to say that we have had some uplift going from 50 to 100 gig. And I believe there’s going to be an uplift going from 100 to 200. But I can’t I can’t. You know, kind of categorize it simply. But I do think. That. You know, that naturally there, there will be an advantage as we move to faster lane speeds. Your next question comes from the line of Quinn Bolton with Needham and Company. The line is open. Hey, guys. Congratulations on the nice results and outlook I guess. Bill, I had a question just on the supply side of things. I think looking at the 10-K, you guys put out, you list this link as sort of your sole provider of AEC cable manufacturing. And obviously. The forecast here is getting pretty big pretty quickly. How are you feeling about AEC supply? You know, are there any constraints you’re working through, any anything to call out on the supply front? I think we’re entering a period of time where we will be talking about supply constraints more frequently now as it relates to our AEC volumes. I don’t I don’t see any, you know, any I don’t see a concern related to the quantity that that we can produce with our partners. I think we’ve proven that over the last year that that we can ramp significantly in a very short period of time. So this is a completely different equation than, you know, thinking about a wafer foundry. And so I do over the last 2 to 3 months we’ve really seen an, you know, increase in the, you know, the, you know, the, the conversations around what is the total potential wafer demand in the market for next year and the year beyond, and the year beyond that. And I do think that if we look at it from a demand standpoint, the market in general is going to kind of quickly get to the point where we’re kind of almost self regulated by by foundry capacity. And so I don’t want to be, you know, too controversial talking about it, but, you know, I think from an advanced node perspective. I think it’s going to be a more frequent conversation about. About capacity constraints at a wafer level. Now, as it relates to Credo, you know, I think that a couple of things. Give us an advantage. We’ve talked about. If you remember the N minus one process strategy, which is we’ve always had a strategy to be an older geometry processes than than our competition. If we can deliver best in class power, best in class die sizes and best in class performance. And so we’ve done that successfully over time. So right now, 12 nanometers, our workhorse. And that’s not as tight as as say three nanometer or five nanometer. And so we feel, you know, we feel pretty good about about where we are just related to, you know, a situation where there’s an increasing demand across the board for, for wafer volume. But I also will say that our foundry partners are very, very well in tune, that the connectivity solutions, you know, the relatively small die size connectivity solutions are critical for, you know, for shipping GPUs can’t really ship GPUs without connectivity solutions. And so I think for a couple of reasons, you know, I think we’re going to be able to manage our way through that. Now as far as our partners within the AEC product. Yeah, I mean, this is why. You know, being vertically, vertically integrated, like we are gives us an advantage because I’ve got a system level supply chain team that is, you know, making sure that all of the partners. That supply components that go into the AEC, that they’ve got as much visibility and much commitment as as they need to go build out what we see. Needed in the future. And so I think great question. I think it’s going to be really topical as we go through calendar 26. Okay.

Quinn Bolton: And for my follow up, just looking at your top two customers, I believe they are still at either 50 gig or 25 gig per lane, but just wondering if you could, confirm that that at least you know the soul feels like the vast majority of your AEC business is at 50 gig per lane, and it sounds like there’s an opportunity that is, those customers. Ultimately transition to 100 gig per lane. There’s probably some ASP lift you would see with that transition. I won’t ask you to comment on specifically when they may transition, but just I don’t think it’s happened yet and was hoping you could confirm that, that the top two guys are still either 25 or 50 gig per lane. I’ll confirm that that we’re in production with 25 gig per 50 gig per lane, as well as 100 gig per lane and probably one of the fastest growing parts of our business has been the shipments of 100 gig per lane solutions. And so the, you know, the yeah, you’re right that it’s not so simple for me to categorize it. I do think that over time, you’ll see the entire customer base moving to 100 gig per lane and then making a move towards 200 gig per lane over the next 2 to 3 years. So I think generally your your the trend that you’re referring to, I think you know that we can say generally that, that it’s accurate, that we’ll see uplift as the market migrates towards faster speeds. Your next question comes from the line of Suji D’Silva with Roth Capital Partners. Your line is open. Hi,

Suji D’Silva: Bill. Hi, Dan. Congrats on the progress here. Maybe you could talk about your customers now. You know when you first ipo’d you had a handful of customers, now you’re, you know, gaining with five customers here potentially for the hyperscalers that don’t kind of use you at a scaled level, you know, 10% plus type levels. I know you’re in all of them at some level. What what is the difference between the customers you haven’t penetrated yet and the ones you know, you’re getting to ten plus percent in, in various quarters. We look at every one of the hyperscalers as almost a different market. You know, they’re all trying to maybe solve the the same problem generally, but there’s so many different ways to to solve those problems. And so network architecture is, is very much specific to each one of our customers. And, you know, I can tell you that, you know, the first program that we engage with, you know, typically that’s led to many other programs within the same customer. And I think that. As we think about the customer base right now, we think of of six hyperscalers in the US and we think of a handful in, in Asia. But I think we’re going to be talking more and more about that next tier of of customer, because I think it’s going to be possible to drive pretty big numbers with that, with that next tier of of data centers. So generally, I think that that as I think about our business, you know, this is a this has been a very significant quarter for us in a sense. You know, that we’re that we’re showing a path to a much more diversified business, not just from a customer base. But from a protocol perspective with PCI as well as from a, a. You know, just the overall Tam expanding by addressing a much broader market with our system level solutions. And so if you think about it. You talk we talk about Omni Connect first. And we’re really addressing die to Die or Chip to chip connections at a system level. And we think about retirement. You know, those those connections can probably be up to a half to one meter. And typically on an appliance card or a switch card. And we think about a up to seven meters, we think about alks up to 30m. And we think about ZF optics up to a kilometer or beyond, whatever the maximum length is within the data center. And so I think in the in the past 90 days, this has been probably the most transformative from a news standpoint. We’ve been working on these things for, you know, for for 18 months or so. But now being able to talk about it, I think it shows a clear path to a much more diversified company long term, as we, you know, think about moving the company from that billion dollar threshold of revenue annually to to 5 billion and beyond over the next several years. Okay. Appreciate how you classify the products there for us. And then my other question is on manufacturing. I know with you’re doing the cable manufacturing and how selling the entire cable solution, is it the same strategy for ALK? Will it be modules versus cables outsourcing any color there available? The strategy for ALK will be very similar to the strategy for Apex. We intend to to own the entire stack. Take accountability for the entire system solution. And so we’ll we’ll see as that develops that, you know, that will be a very similar model to what we’ve got today with apex. Your next question comes from the line of Jay Rakesh with Mizuho. Your line is open. Yeah. Hey,

Jay Rakesh: Bill and Dan, congratulations here. Just a. Quick question on the scale up. Do you see those revenues start to ramp in the second half? Calendar 26. And I think you mentioned cable’s ELC in calendar 27. Is that the way to look at it? For scale up specifically we’re going to enter that market with PCIe Gen six. Solutions. Now of course we’ll entertain Gen five in the interim. But but really the you know, the product is targeted for Gen six. We’ll bring both retailers and ex to market. Simultaneously. And you know we see a big opportunity for both. If I think long term that will migrate to faster lane speeds and PCIe Gen seven. You know is is absolutely a conversation. We’ll deliver products. To the market. You know to to meet that protocol that that, you know, Gen 728 gigabits per second. Per lane protocol. But also there’s a huge conversation about 200 gig per lane. And, you know, over time, you know that the, you know, the protocol war will settle down. And and, you know, ultimately 1 or 2 or even three will be in production. We feel good about that because all of all of the things being discussed right now at 200 gig per lane, use the same IEEE service. And so we’ve talked about being protocol agnostic for the 200 gig per lane generation. And I’ll say that, you know, all of the products that, you know, that we’ve talked about, we’re going to be delivering solutions. For scale up with all of those products, including X and Alks. And if the market moves towards longer connections. We will surely move to ZF optics as well. But that’s yet to be determined. Got it. And then longer term, as you you obviously are seeing a pretty strong AC ramp. How should we look at the gross margin profile? As you know, optical DSPs are starting to ramp as well. Just longer term. How to look at those those margins. Thanks. Yeah, we’ve been very consistent in saying, you know, our long term expectation for gross margins. Is, you know, in the 63 to 65% range. So we are clearly at a point in time right now where we’re a bit above that, but we don’t expect that to be the case longer term. You know, if you look at the more medium term. Probably, you know, we guided to 65 at the midpoint. So we’ll be kind of near that high end of that long term expectation. But but just longer term expect that to settle down into an area that historically companies like us have have been in. Your next question comes from the line of Sean Lowe with TD Cowan. Your line is open. Hey guys, thanks for letting me on the call. And obviously, congrats on the great results. I had a question about the ALK. Allergy and you know, your relationship with Hyperloop specifically. I think, Bill, you just alluded to having been working on this, you know, for the last 18 months or so, and I would assume that that’s kind of how the acquisition came together. And then so maybe just talk about that. And then if you could address, you know, if we’re sitting here in 2027, 2028 and ALK haven’t ramped, has it? B is this because of a technology problem that that you guys still need to figure out? Or is it because of a, you know, a business problem that that maybe the market didn’t go the direction that you, that you thought it would? Thanks. I think it goes back a couple of years ago. That we first became very interested in Micro-led technology as an option to bring, you know, really differentiating products to markets, to market. You know, first with ALK and then the second step is, you know, to, you know, to answer some of the pitfalls of package optics, the, you know, the first couple of companies that we that we engaged with. Were independent companies and, you know, ultimately we made the decision earlier this year. To to. To basically bring the bring the technology in-house, bring the team in-house so that we, you know, could have a very predictable outcome on, on, on time to market. And so at this point, what we’ve learned over the last 18 months or two years is significant. The team that we’ve combined forces with Hyperloop. We feel like right at this point, it’s it’s more of an execution play. It’s not really a, you know, so the technology I think is, well, well along the path to being developed. Now it’s just an execution play bringing it to market. And so I feel confident about bringing a product to market in, in our fiscal 27 and ramping first initial ramps in fiscal 28. You know, from the standpoint of our confidence on this, as far as this being a product that that that’s going to resonate with our customers, I think you. Know, that we’ve got several years under our belts. Bringing new products and categories of products to market. The initial conversations with customers, I don’t see any I don’t see any major barriers to overcome from the standpoint of customers accepting the product. These are going to be, you know, these are these are going to be book ended solutions. So they’re going to be delivered in the form of a cable. And, you know, the bottom line is when we deliver on the promise of. Reliability, power efficiency and system cost, that’s equal to X. But you get a thinner wire and you get longer length. I mean, it’s really you know, it’s really, you know, the perfect type of product. And so I, I really again view this as more of an execution challenge. And I feel very good about the team. We’ve got in place, you know, the additions that we’ve got planned over the next 12 months to to make sure we get this right. Yeah. Thanks for that. And then quick follow up on on ZF optics. I understanding that there are a system level solution. Is there a is there a line rate or a or a lane rate that the ZF optics platform is, targeting to intersect with. Or is it. Relatively agnostic, can be leveraged at 50 gig 100, gig two 200 gig per lane type of of applications. It can be leveraged across the board. The first product that will go to production with is 100 gig per lane. It’ll be 800 gig ports that that we’re addressing, but there’s definitely a path to 1.6. But if we had a customer that wanted to. Bring a product to market, that was 50 gig per lane, there’s no issue with that. Awesome. Thanks for the color, guys, and congrats again. Thanks. Your next question comes from the line of Christopher Rowland with Susquehanna. Your line is open. Hi guys. Thank you for the question. And congrats on the pretty amazing results here. And yeah, these are probably going to be for Dan. So you guys in a very good way. Kind of blew up my old model. So you know I think we’ve talked you guys talked about more than 170% year over year growth. Perhaps we can put some brackets or talk about next year. Obviously we’ll have a deceleration. But do you think that we could grow at a at a rate similar to the street where it was? Or do you think that needs to come down a little bit, just given the better results for this fiscal year? Just any sort of commentary as to the growth rate for next year would be phenomenal. Yeah. We so in my prepared remarks. I specifically said, you know, mid-single digits, revenue growth sequentially through fiscal. 27 so, so that’s the expectation that we’ve that we’ve set you know, we set that expectation probably 3 or 4 quarters ago as well. If you go back and look at things and we’ve outperformed that. So sure things could change. But we’re not setting any expectation. That’s that that’s different from side. Okay. Okay. Thank you very much for that. I guess I don’t know. Does that were we at the higher end of middle, middle mid-single digits. And do we move lower just given the better results. And then my second question Dan is around opex. So a pretty big guided bump for next quarter, you know. Maybe talk about that. Is that a but just a bunch of engineers coming on. Is that more one time? And then do we take that bump and then just forecast it across every quarter moving forward. How should we think about that. And or like just you know, what do you think opex might grow at a percentage of revenue if that’s easier to discuss. However, you would frame it. Yeah. So. So let me just first state that we’re continuing to manage our operating expenses in order to support the revenue growth that we foresee. And as you know, all of these projects, all of these pillars of growth that Bill has talked about, you know, there’s a long gestation period for for all of them. And you need engineers, engineering talent to be able to execute on that. So we’re I feel like we’re in a great position to do so. Our Q3 OpEx guide was up more than it has been in the last few quarters, up 22% at the midpoint. But as you dig into our Q, you’ll see our R&D spend was sequentially down in Q2. So in in one way, we’re kind of making up for that small decline. So long story short, guiding to 70 million at the mid-point. That does set a new base. There’s additional project related spend within that. And plus additional hiring. We’ve brought the Hyperloop team on board. There’s a lot of different factors that go into that number. But. If you plug that number into your model and have a small sequential increase in Q4. You’ll kind of end up at a 50% year over year opex growth from fiscal 25 to fiscal 26, which is was also in my prepared remarks. So hopefully that’s helpful. Excellent. Thank you. Your next question comes from the line of Carl Ackerman with PMP Paradis. Your line is open. Yes.

Carl Ackerman: Thank you gentlemen, I have two questions, if I may, first, could you speak to why you are now licensing your active electrical cable IP to third parties and how this agreement reflects your perceived competitive moat and go to market for aches. To give. Background on on the the case that that we filed with the ITC. This is a market. The AEC market that credo pioneered over the last 7 or 8 years. We spent tens of millions of dollars. Establishing the innovations required to to build these products. And it’s great to see that the product category is, you know, has realized what we felt would be a multibillion dollar. Market potential. And so along the way, you know, we’ve been pretty communicative with others that are in the market or showing intent to enter the market. That we’ve got IP. And we’re intending, you know, to to make sure that there’s respect for that IP. And so, you know, we got to the point where we felt it necessary to file with the ITC because we weren’t getting, you know, great respect or great acknowledgment of, you know, the fact that the path was pretty well defined by, by credo and our engineering team. And so I think we feel really good with where we are. We never we never thought about this market as being, you know, a market that would take off if there was a single supplier. And so our customers all want. Multiple suppliers. Ultimately, we’ve, you know, we’ve landed in a good spot with three other conversations that we’ve had thus far. We’ve got a couple more in flight or maybe even more than a couple more in flight. This doesn’t change anything. Competitively for us. We’ve always thought about. You know, competition as you know, a challenge of moving more quickly and in a way that delivers what our customers want. And so it’s a function of delivering what they want. First. Having it be qualified first, ramping first, delivering flawlessly as they ramp and as they are in high volume production. That’s really our focus as a team, both at an engineering level as well as an operations level. And so I would say that we’re satisfied with with where we are. Competitively and we’re satisfied with where we are with the results thus far that we’ve seen. As we’ve protected our IP. Got it. That’s helpful. Bill. Maybe a question for Dan. You know, you know that you’ve got 12 minutes of visibility with several hyperscale customers. I guess it begs the question, what was the largest delta in your upwardly revised outlook for your prior outlook of 960 and change? I guess how much of it was simply the ramp of your the fifth hyperscale customer versus just higher order rates of existing programs, or even new AEC applications across scale out in disaggregated chassis. At some of these other customers. Thank you. Hey, what I’d say this is more of a general comment. And this is true of the last 3 to 4 quarters. You know, we’ve seen continuing strengthening of our forecast throughout the quarters as they proceeded, which is how we’ve gotten into this particular rhythm that we’re in right now. So it’s not specific to a customer. It’s perhaps more of an industry trend. And and we’ve benefited from that. So that what we’ve seen. In your next question comes from the line of Joseph Cardoso with J.P. Morgan. Your line is open. Hey.

Joseph Cardoso: Thanks for the question. Maybe for my first one. You know, I just wanted to touch again on the entry into the optical transceiver market beyond just DSP. You know, this is obviously a very large and expanding Tam, but perhaps one where current industry margins are somewhat below your long term targets. So maybe can you just take a second and just talk about how you’re thinking about the margin opportunity here? And also curious whether you’re focused on just selling the full modules or if there’s an opportunity to drive a touch of the DSP pilot software, etc. and sell those building blocks of the zero flap solution to potential customers. And then I have a follow up. Thank you. Yeah.

Bill Brennan: Absolutely. Thinking about this product in a similar way that we think about the other system level products, we’re going to take full ownership and accountability for the entire system level solution. So we’re not necessarily competing in in the. Current commodity market. If, if if a customer is looking, you know, for that. Step function in reliability that you can get by. Going up the stack with the solution we’re bringing to market. I’m absolutely. But it’s not a conversation about, you know, what is the price of a transceiver in the market. This is really a system level solution. And so it’s it’s a combination of all things, you know, DSP, it’s a combination of, you know, the software that we’re bringing and it’s it’s really most importantly is that is that the tight interaction that we’ve got with with our customers. And so I think we’ve been really clear and I think Dan, specifically has been clear in stating that we don’t see any change to our long term gross margin model. Nope. Got it. Very clear, Bill. And then maybe just a quick clarification on the fifth customer in the quarter. And maybe this is anecdotal, but it sounds at least like they’re tracking ahead of expectations relative to last quarter with some initial revenue this quarter. But just wanted to clarify if that was the case. And as we think about that, customer tracking into the back half of this year, is there any opportunity for this customer to to be 10%, at least on a quarterly basis? Now, in the back half or, or has the denominator just kind of outpaced that that opportunity there? Thanks for the questions. Appreciate it. Things take time. And you know I think if you if you look at the base that we’re talking about, the 10% number has changed pretty drastically from a couple of years ago to today. Things take time to rent. And so when we think about, customer number five, we think about initial revenue. This year, there’s not a chance that that will be a 10% customer this fiscal year. And I do think that the customer has the potential of being a 10% customer. You know, in, in especially if we think about it at, at a quarterly level first and then an annual level secondarily, no question that they’ve got the type of size to be able to drive that type of number, but it’s going to take time. And your last question comes from the line of Sebastian Nagy with William Blair. Your line is open. Yeah.

Sebastian Nagy: Thanks for squeezing me in here. And congrats on a nice set of results. I’ll ask both my questions together in the interest of time. The first one is, you know, credo is is has an advantage in that it’s agnostic to the underlying compute could be merchant GPU racks, ASIC racks, even CPU servers. So could you maybe talk a little bit about how much of your business is tied to ASIC versus merchant silicon deployments today, and where that share might go over the next year? And then my second question I just wanted to ask about the timing of purchases from your customers. How aligned are AEC purchases with the GPU or ASIC purchases, and do customers typically purchase ahead or one after the other? And is there any risk of inventory build if they’re purchasing ahead of GPU orders? Thank you. We’re not really able to to break out the percentage of. GPUs that are, say, internally developed or commercially available in the market. We don’t actually track it that way. I can say we’re you. The first comment that you made is absolutely accurate, that we’re agnostic to the type of GPU that’s being deployed. I will say that from a deployment standpoint. The second question that you asked, the, you know, my belief is that, you know, everything is is ordered in a way that would have all of all of the the necessary components being delivered at the same time. Now, it’s a very, very complex supply chain that our customers are dealing with. But I think they’re, you know, they’re ordering the. Solutions right along with the GPUs. So we have pretty good visibility within, you know, within the supply chain from delivering our delivering our products. All the way to having those products deployed. And so we get a good sense of the type of inventory that exists within the partners that each one of our customers use to, to stage inventory. And we feel pretty good about we feel pretty good that, that there’s not really a bubble of product that’s, that’s sitting in inventory right now. Great. Thank you. And with no further questions, Mr. Brennan, I turn the call back over to you for closing remarks. Yeah. Thank you. I really appreciate the strong interest in credo. We’ll talk to you all soon. We’re a little bit off schedule, so the call might be a bit rushed and a bit delayed, but again, really appreciate it. Thank you very much. This concludes today’s conference call. You may now disconnect.

BizLink's announcement regarding New Fusheng Optoelectronics today appears to be a strategic move for their future ALC (Active LED Cable) roadmap. New Fusheng Optoelectronics specializes in the manufacturing of MPO/MTP high-density fiber optic connectors and multi-core fiber patch cords. ALCs require high-density fiber bundles to transmit the optical signals emitted by MicroLEDs.

New Fusheng Optoelectronics possesses exactly the mass production capability required to precisely align multiple fibers and package them into connectors. (The most technically challenging aspect involves polishing the connector end-faces to a specific angle to prevent back-reflections from interfering with the laser.)